| Changing the interest rate. |

1. (i)

(ii)

The decrease in the repayment amount reflects what a good businesswoman Phoebe is.

If her interest had remained at 4% for the entire time, her repayments would have been $1,106 per month. If the interest rate had been 7% for the entire 15 years, her repayments would have been $1,521 per month - just above the level she started with.

Hence she has elected to pay more money earlier (at the lower interest rate) and that has decreased the rate of her repayment after the second year.

(iii)  |

| |

2. (i)

(ii)

(iii)

(iv) Saving is (288 × $2,270.33) - (178.4 × $2,937) = $129,894.24 - WOW!! |

| |

3. (i)

(ii)

(iii)  |

| Increasing the regular repayment amount. |

6. (i)

(ii)

(iii)

In the original agreement, Pete would pay

20 × 12 × $1075 = $258,000.

Under the revised agreement, Pete pays 5 × 12 × $1075 = $64,500 for the first 5 years.

He then pays 110.75×$1500 = $166,125 to give a combined total of $230,625.

Hence Pete saves $258,000 - $230,625 = $27,375 (which is about 25.5 months off the original interest agreement term). Big difference to one's peace of mind and feeling of freedom!!!

|

| |

7. (i)

(ii)

(iii)

Hence Ben repays the loan in an additional 6 years 1 month + $175

instead of the originally planned extra 10 years.

Presumably Ben would also pay the extra $175 at the end of the 73 month just to clean up the loan. |

| |

8.

(iii)

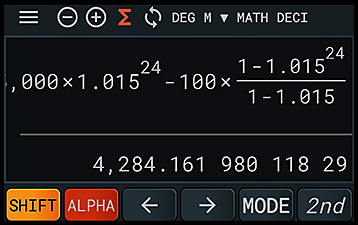

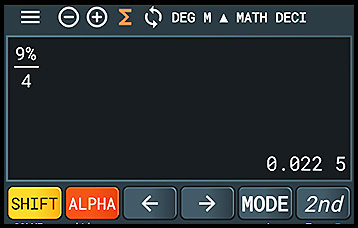

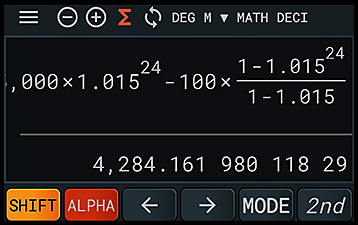

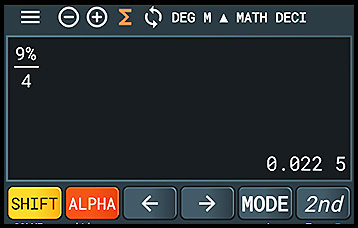

FOR the first calculation of PART (iii) - the 5(000) is missing from the window below.

|

| |

9. (i)

(ii)

(iii)

(iv)

(v)

(vi) Balance of Ellen's loan = $268,766.05. |

| |

10. (ii)

Total paid on loan over 24 months = $10,737.04.

(iii)

(iv)

(v) The difference is that Ted pays less at the beginning ($395.29 against $443.21) and it takes until about month 11 for the repayment amounts to be about equal. To that point the balance for the equal payments would be lower than the sliding repayment balance. After month 11, Ted's strategy would be paying more back each month and so would slowly equate and then result in an amount lower than the fixed amount balance. The difference in total interest over the two years is about $75 in favour of Ted's strategy. |

| Making a special contribution. |

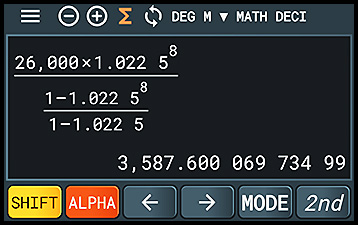

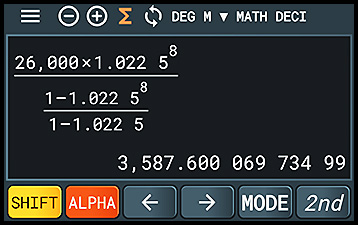

11 (i) 9% p.a. converts to 1.0025.

(ii) In two years there are 8 quarters and then the

loan balance = 0.

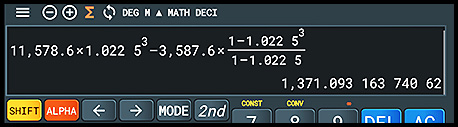

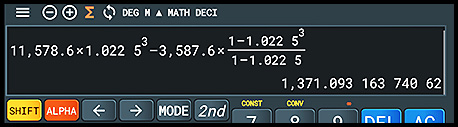

(iii) at the end of 4 quarters, Jonah owed $13,578.13 (substituting n = 4 into part (i)).

He then pays the extra $2,000 giving a balance of $11,578.13.

After 3 more payments, his balance is $1371.09.

With interest on this amount for the quarter, total owing is $1,401.94. Final payment is therefore reduced from $3587.60 to $1,401.94 - by $2,185.66. Hence a saving of $185.66 when the extra payment is accounted for. |